Noticias

💥 Gold Hits All-Time Highs: Diversification Strategies and Market Trends 📈

💥 Gold Hits All-Time Highs: Diversification Strategies and Market Trends 📈 📌 Gold prices have reached all-time highs, exceeding $2,250 per ounce, marking a 38% increase from the low point in 2022. Despite the record highs, many analysts remain optimistic about gold...

💰 Gold and Bitcoin “hand in hand” to their peaks 📈💥

💰 Gold and Bitcoin “hand in hand” to their peaks 📈💥 📍 Gold and Bitcoin, traditionally viewed as contrasting assets—one a safe haven and the other volatile and speculative—achieved record highs in tandem. Gold surged to $2,141 per ounce, attributed to geopolitical...

🚩 Is the US stock market too concentrated🚩

🚩 Is the US stock market too concentrated🚩 📌 The recent surge in the S&P 500, surpassing the 5,000-point threshold, has sparked discussions about the trajectory of the index for the rest of the year. Just months ago, analysts were projecting a modest increase for...

🚀 NVIDIA to the sky! 🚀

🚀 NVIDIA to the sky! 🚀 📌 After releasing yet another staggering sales estimate, Nvidia Corp. jumped in late trade, giving a boost to a stock rise that had already made the company the most valuable chipmaker in the world. The corporation announced in a statement on...

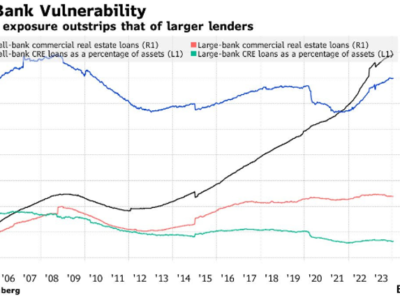

🏡📉 The Real Estate crisis looms over banks

🏡📉 The Real Estate crisis looms over banks 🚨 During the last few days, investors have been focusing on the regional banking sector, which seems to be facing new difficulties. In particular, New York Community Bancorp fell 42% after announcing a loss and a dividend...

📈 S&P 500 is at its peak: now what? 🔥

📈 S&P 500 is at its peak: now what? 🔥 📍 The S&P 500 Index has reached its all-time high, which it last touched in January 2022, after 746 days. Using S&P 500 data going back to 1950, we can observe that the average fall during a bear market was 35%....

📉 Germany in reverse gear 📉

📉 Germany in reverse gear 📉 📌 The Federal Statistical Office Destatis reported that 2023 ended with the GDP declining by 0.3%. This was the biggest slowdown since 2020, when the Covid pandemic had sent the economy down 3.8%, breaking a 10-year positive upward trail....

China will facilitate foreign investments 💸💸💸

China will facilitate foreign investments 💸📍 State media said that Chinese Vice Premier He Lifeng promised to facilitate foreign institutions' investment in the nation at a meeting with global financial leaders on Wednesday. The gathering takes place at a time when...

📈 Bitcoin soars on the first days of the New Year 📈

📈 Bitcoin soars on the first days of the New Year 📈📌 Bitcoin soared to $45,000 for the first time since April 2022, owing to an increase in geopolitical tensions in the Red Sea and growing optimism about the approval of a bitcoin exchange-traded fund. According to...